One of the most popular ways to invest money is into real estate. You are probably reading this article because you know someone, perhaps your own parents, who have enjoyed ludicrous returns over the last 20 years. Most millennials grew up with these crazy returns and desperately want to enter the market.

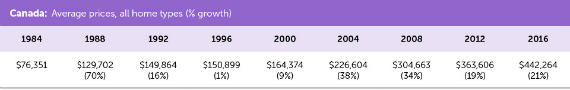

Take a look at this little picture provided by the Canadian Real Estate Association:

That is all of Canada. Lets take a look at a few of Canada’s main cities:

From an average of $376,236 in 2007 to $822,681 in 2017 in the Greater Toronto Area. Wow.

2018 was a rough year for real estate sales but even with a 5% – 10% drop, any of us would still be happy right?

Numbers like these make owning a property a very attractive option.

Purchasing an investment property means buying real estate that can generate income for you in the form of rent. This investment provides you with a secondary source of income to help pay down bills or provide a financial cushion in case you decide to quit your job.

Another benefit of real estate investing is that you are the boss. You get to decide which property to invest in, how much to charge for rent and how active you want to be in operating your new business.

Types of Investment Properties:

• Single-family: vacation rental, Airbnb, single unit condo, traditional home

• Multi-family: apartments, condos, co-ops, townhomes

• Office: office condos, urban office buildings, medical offices

• Retail: single-use, community center/strip mall, standalone buildings

• Industrial: manufacturing, flex space, R&D, warehouses

• Hotel

The best way to begin investing in properties is to start small.

Getting familiar with local regulations, dealing with tenants and negotiating contracts can be a bit of a learning curve. The most popular investment properties for starting investors are single-family units, townhomes or duplexes, office condos or small warehouses.

Buying and renting out a condo on Airbnb or VRBO is a great way to try it out see if you enjoy real estate investing before you ramp up your portfolio.

Always treat real estate investing like a business, even if you only have a small property and you will succeed.

Next Steps:

Once you decide on the type of property you want to invest in, study the area, demographics and growth prospects to determine if there is a good opportunity to make money.

While you may find a real estate agent willing to help you out, you shouldn’t rely upon them and do your homework instead. Find some popular real estate investing blogs, study successful Airbnb operators and read local business publications.

Take note of large companies expanding or relocating to your target area which may indicate a surge in population for your city.

Before you take the plunge into your first investment property don’t forget to account for all of the possible expenses.

These include real estate agent commissions, mortgage fees, maintenance, repairs, utilities, insurance, advertising for tenants, cleaning, taxes and legal fees.

You may consider hiring a property management company which can help take care of most of these items while you are still learning the business.

You may not be the next real estate tycoon, but by wisely purchasing investment properties you will create a stream of income, gain freedom and perhaps even discover a new career.

Downtown Money is a millennial online magazine aimed at helping our generation move forward. Follow us for the latest news worth your time.